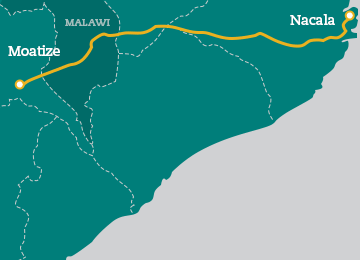

A mega project which will link Mozambique’s Nacala port to Moatize coal mine has received financial support majorly from Vale and Mitsui companies. Vale, a Brazilian mining company in partnership with Mitsui, Japanese company signed an agreement to finance NCL project with $2.73 billion. The consortium of financial institutions including Standard Chartered Bank, Sumitomo Mitsui Banking, Sumitomo Mitsui Trust Bank, The Bank of Tokyo Mitsubishi UFJ, Nippon Life Insurance Company and Mizuho Bank are expected to provide a loan of $1 billion. African Development Bank (AfDB) is expected to invest $300 million while a loan of $400 million will be secured from Credit Insurance of South Africa. The remaining balance of $1.03bn will be a loan from Japan Bank for International Cooperation. The plans for the project also include new track installation and construction of a maritime terminal.

The agreement states that the loan will be repaid from the tariff from general cargo services and coal transportation services offered by NLC and repayment period is fourteen (14) years. The project will revive the operations of the 682 km existing railway track that connects Mozambique to Malawi. Vale reported that the financial aid given showed government support and institutional maturity in Malawi and Mozambique. Having identified that there’s need to sustain Moatize coal mine’s capacity, Vale stepped in to invest in the project, and a portion of Vale’s loan will be channeled to boost production of NCL as lion’s share be directed for construction works of NCL. After successful completion of the project, it is expected that the annual capacity of production of coal will increase to 18 million cubic tons.